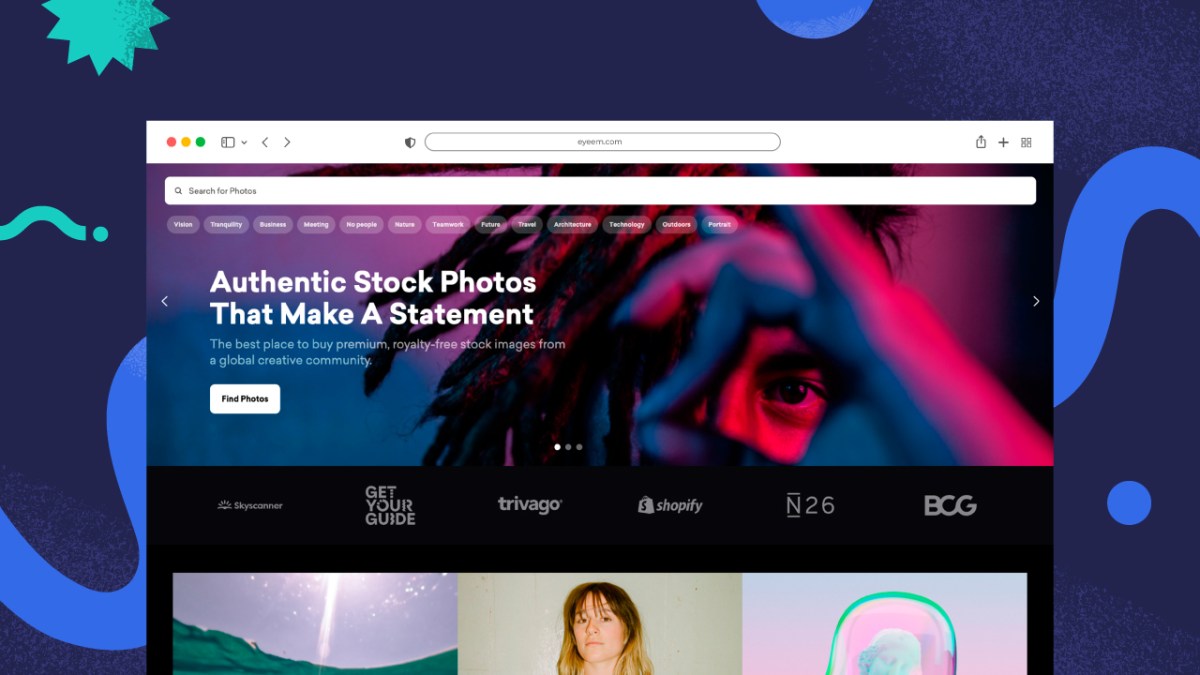

EyeEm, the Berlin-based photo-sharing community that exited last year to Spanish company Freepik, after going bankrupt, is now licensing its

LATEST NEWS

TECHNOLOGY

Photo-sharing community EyeEm will license users photos to train AI if they don’t delete them

EyeEm, the Berlin-based photo-sharing community that exited last year to Spanish company Freepik, after going bankrupt, is now licensing its

Overwhelmed? 6 ways to stop small stresses at work from becoming big problems

akinbostanci/Getty Images Modern professionals have busy workloads and juggling all these demands is tough, especially when unexpected challenges appear on

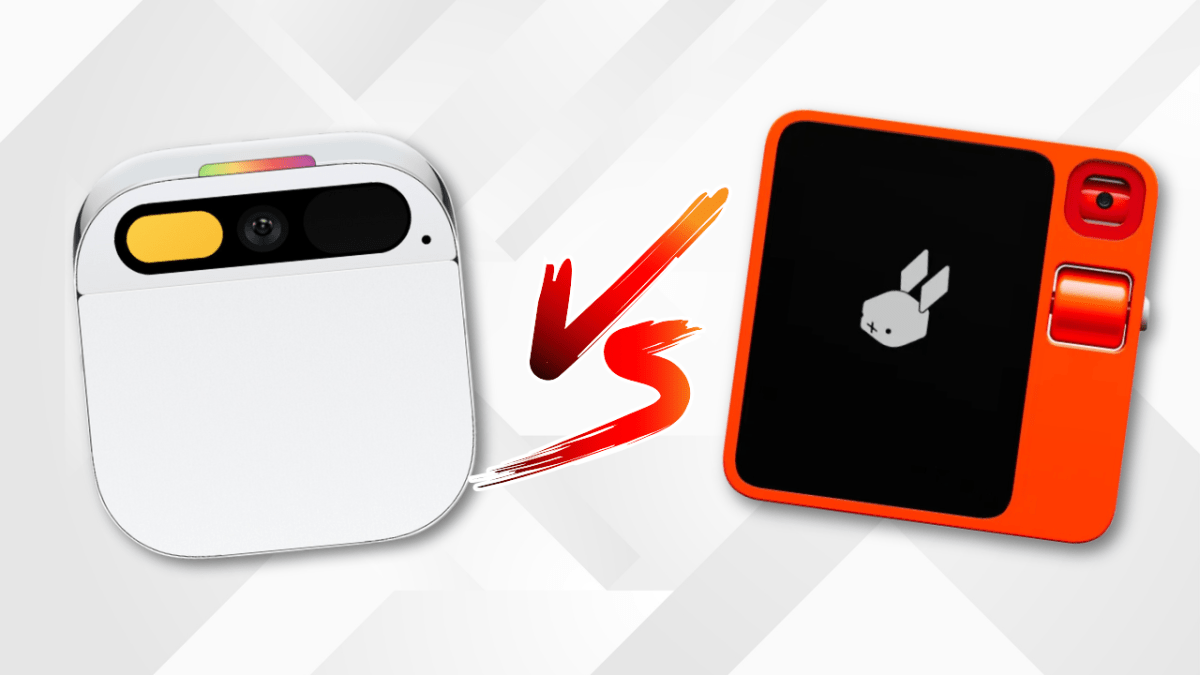

Watch: Between Rabbit’s R1 vs Humane’s Ai Pin, which had the best launch?

After a successful unveiling at CES, Rabbit is letting journalists try out the R1 — a small orange gadget with

A Costco membership is just $20 with this deal

A new Costco membership comes with a free $40 gift card right now. StackSocial Thinking about buying a Costco membership?

Thoma Bravo to take UK cybersecurity company Darktrace private in $5B deal

Darktrace is set to go private in a deal that values the U.K.-based cybersecurity giant at around $5 billion. A

World

Key takeaways from fourth day of testimony in Trump’s hush money trial | Donald Trump News

The fourth day of testimony in former United States President Donald Trump’s New York hush money trial has concluded, with