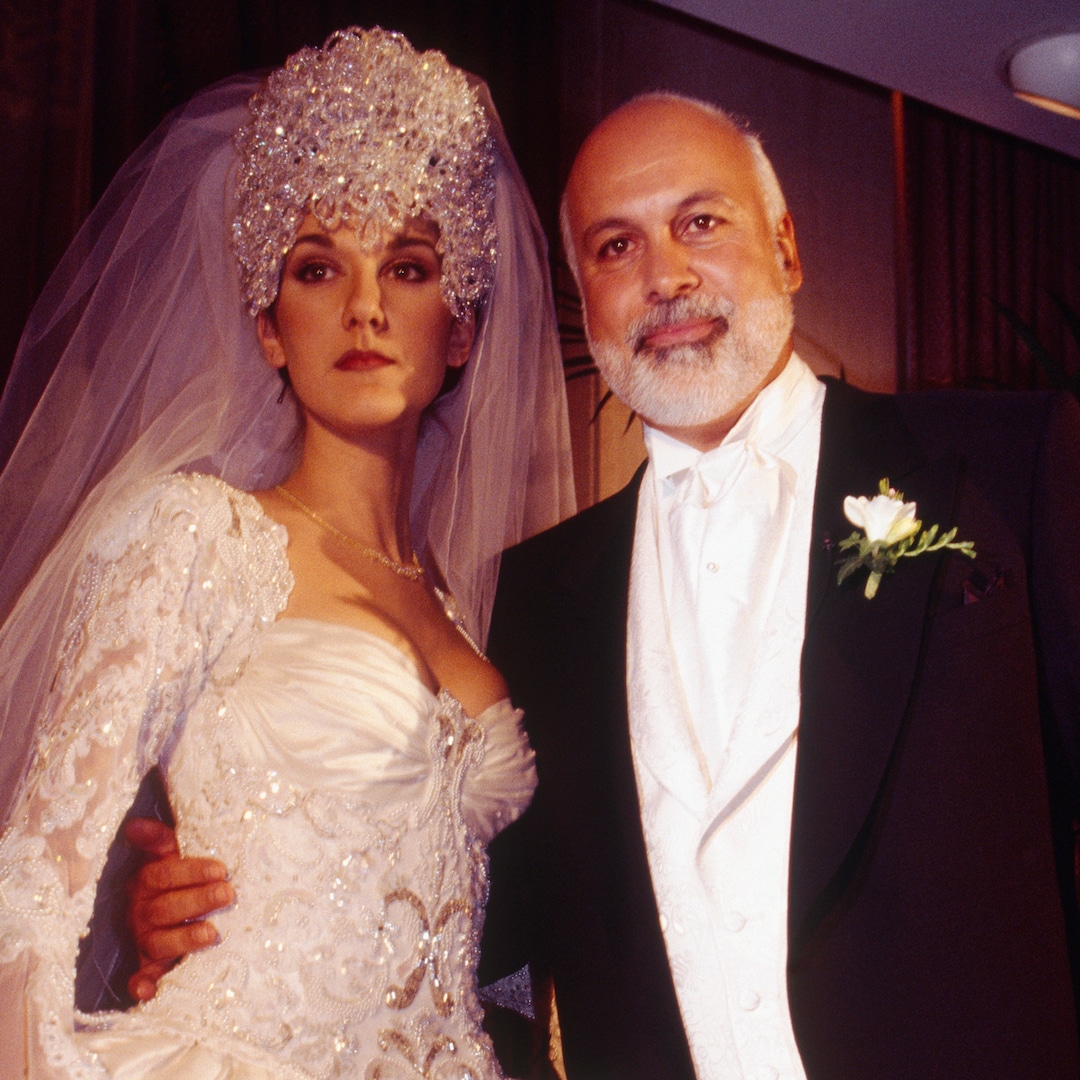

Dion shared that she had been diagnosed with a “very rare” progressive neurological disorder called stiff-person syndrome, surely the first

TECHNOLOGY

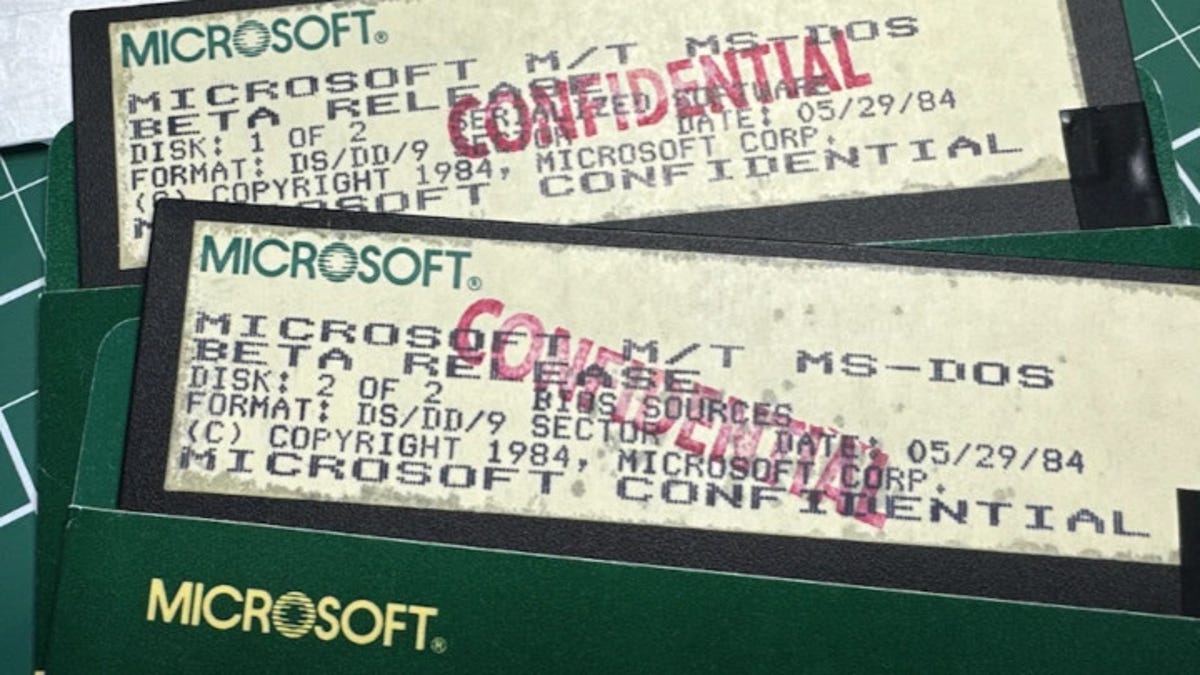

It’s baaack! Microsoft and IBM open source MS-DOS 4.0

Microsoft It’s no joke. Microsoft and IBM have joined forces to open-source the 1988 operating system MS-DOS 4.0 under the

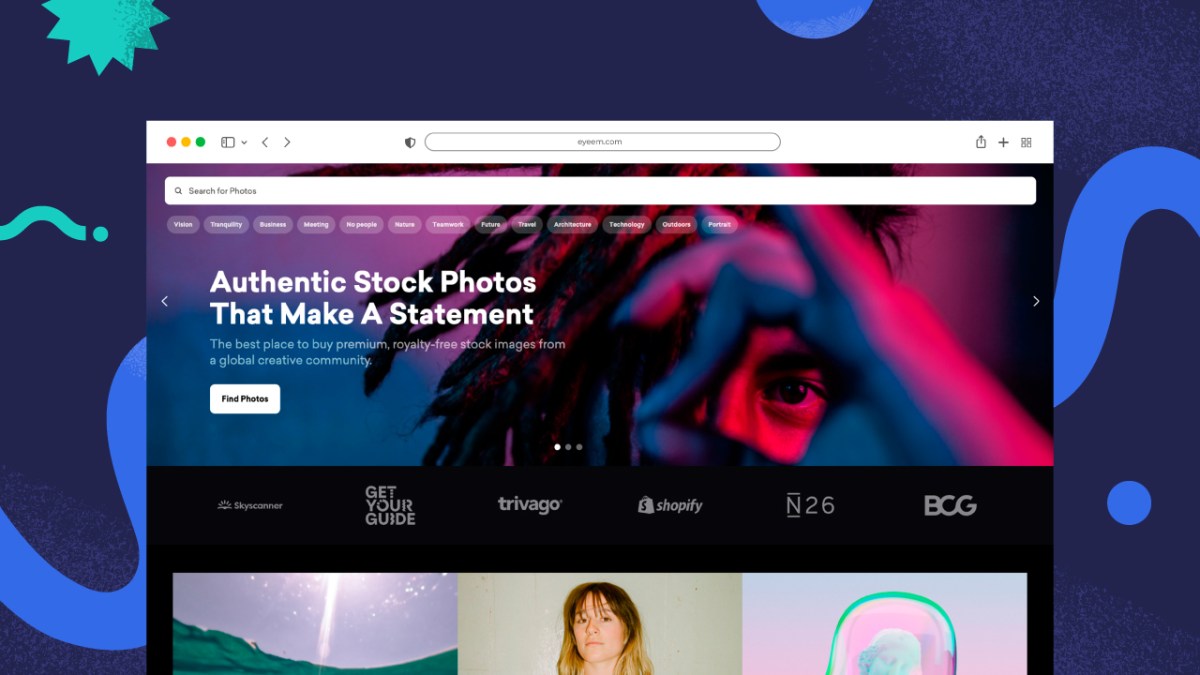

Photo-sharing community EyeEm will license users photos to train AI if they don’t delete them

EyeEm, the Berlin-based photo-sharing community that exited last year to Spanish company Freepik, after going bankrupt, is now licensing its

Overwhelmed? 6 ways to stop small stresses at work from becoming big problems

akinbostanci/Getty Images Modern professionals have busy workloads and juggling all these demands is tough, especially when unexpected challenges appear on

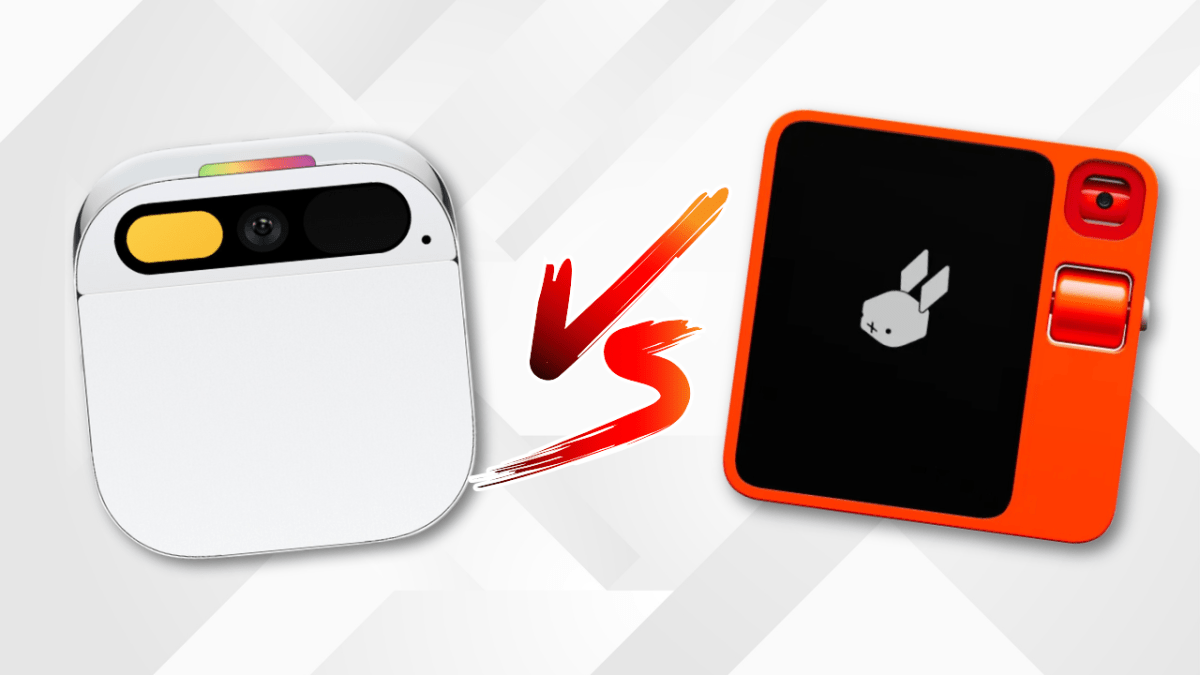

Watch: Between Rabbit’s R1 vs Humane’s Ai Pin, which had the best launch?

After a successful unveiling at CES, Rabbit is letting journalists try out the R1 — a small orange gadget with

A Costco membership is just $20 with this deal

A new Costco membership comes with a free $40 gift card right now. StackSocial Thinking about buying a Costco membership?

World

Generation gap: What student protests say about US politics, Israel support | Israel War on Gaza News

Washington, DC – A Gaza-focused campus protest movement in the United States has highlighted a generational divide on Israel, experts