It took less than three minutes of Liverpool’s win over Fulham on Sunday for Trent Alexander-Arnold to demonstrate the unique

TECHNOLOGY

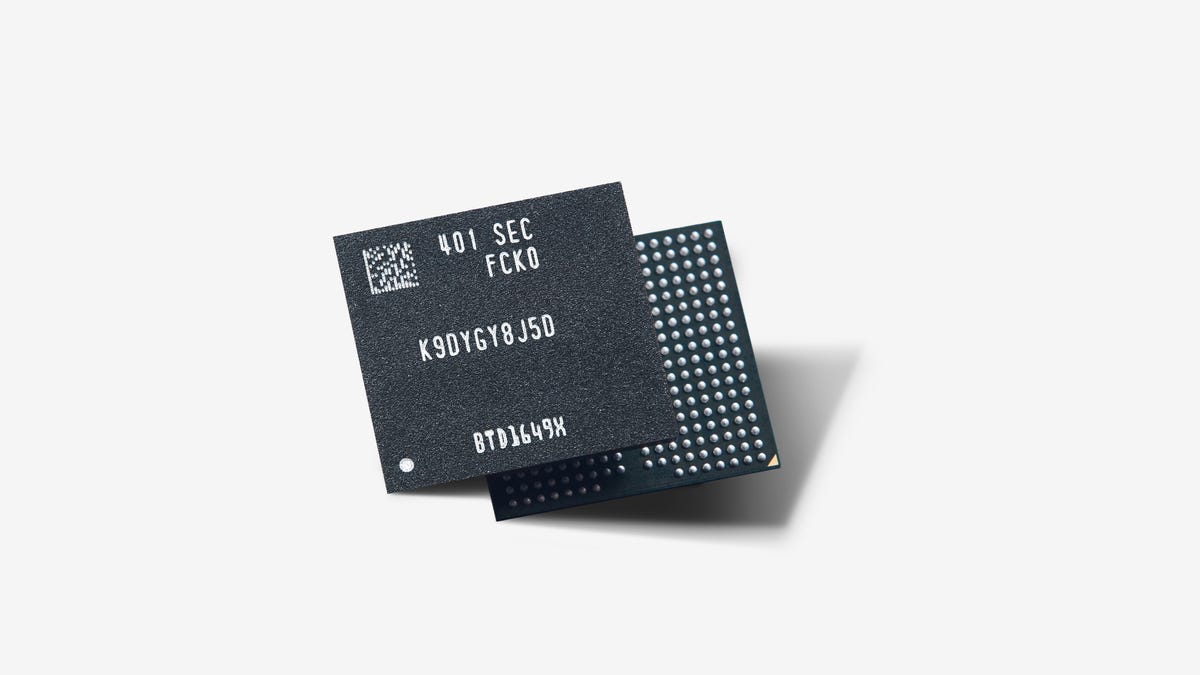

Samsung begins mass production of 9th-gen NAND with 50% upped bit density

Samsung has launched a new vertical NAND (V-NAND) with the highest bit density yet. The South Korean tech giant said

Rivian targets gas-powered Ford and Toyota trucks and SUVs with $5,000 ‘electric upgrade’ discount

Rivian is offering discounts up to $5,000 on its EVs — and a year of free charging — to customers

UnitedHealth says Change hackers stole health data on ‘substantial proportion of people in America’

Health insurance giant UnitedHealth Group has confirmed that a ransomware attack on its health tech subsidiary Change Healthcare earlier this

TechCrunch Space: Engineering the future

Hello and welcome back to TechCrunch Space. Don’t worry — we’ll be diving into the Mars Sample Return news shortly.

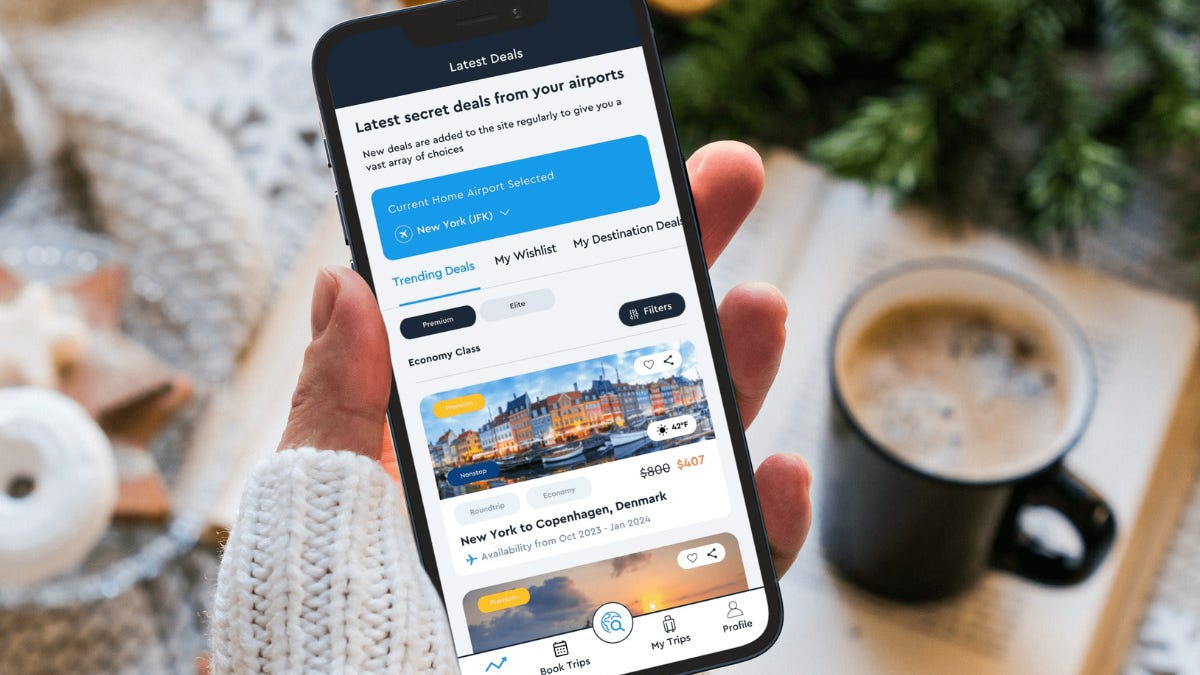

Get discounts on flights and hotels with a OneAir Elite subscription

Snag $710 in savings in this OneAir Elite deal. StackSocial If you’re looking to escape the cold and save money on

World

Watching the watchdogs: The media downplays a big legal story at its peril | Israel War on Gaza

In a fast-expanding global battleground, enablers and opponents of Israel’s genocidal assault on Gaza are facing off in an unusual