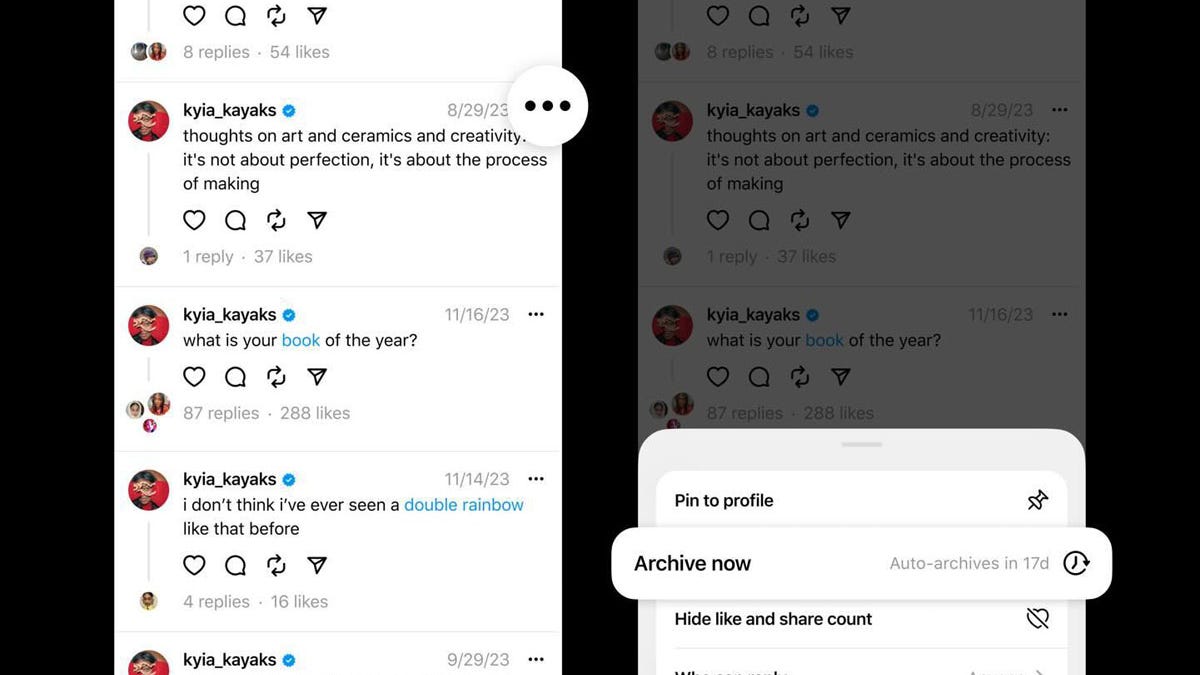

Lance Whitney/ZDNET Meta is testing a new Threads feature that lets you archive your public posts, rendering them invisible to

LATEST NEWS

TECHNOLOGY

Threads tests letting you hide your public posts, as monthly users jump to over 150 million

Lance Whitney/ZDNET Meta is testing a new Threads feature that lets you archive your public posts, rendering them invisible to

Ex-NSA hacker and ex-Apple researcher launch startup to protect Apple devices

Two veteran security experts are launching a startup that aims to help other makers of cybersecurity products to up their

7 reasons I use Copilot instead of ChatGPT

Sabrina Ortiz/ZDNET The launch of OpenAI’s ChatGPT kicked off the generative AI craze and the tool has remained the most

TikTok pulls feature from Lite app in EU over addiction concerns

TikTok suspended a gamification feature in the European Union following an intervention by the bloc. With attention on TikTok’s growing

LG’s TV business return to profitability from Europe demand recovery, streaming

LG Electronics’ TV business has returned to profitability in the first quarter from the recovery of demand in Europe and

World

US TikTok’s future in jeopardy as Biden signs ban bill: What’s next? | Explainer News

The US Senate has overwhelmingly approved a bill that would ban TikTok unless its Chinese owner, ByteDance, divests from the