Those opposed to the changes fear they could allow further extensions to President Faure Gnassingbe’s rule. Lawmakers in Togo have

LATEST NEWS

TECHNOLOGY

Get Microsoft Office 2021 for Windows for $56 right now

Download a lifetime license to Microsoft Office at a deep discount with this deal. Stack Social If you need access

This Week in AI: When ‘open source’ isn’t so open

Keeping up with an industry as fast-moving as AI is a tall order. So until an AI can do it for you,

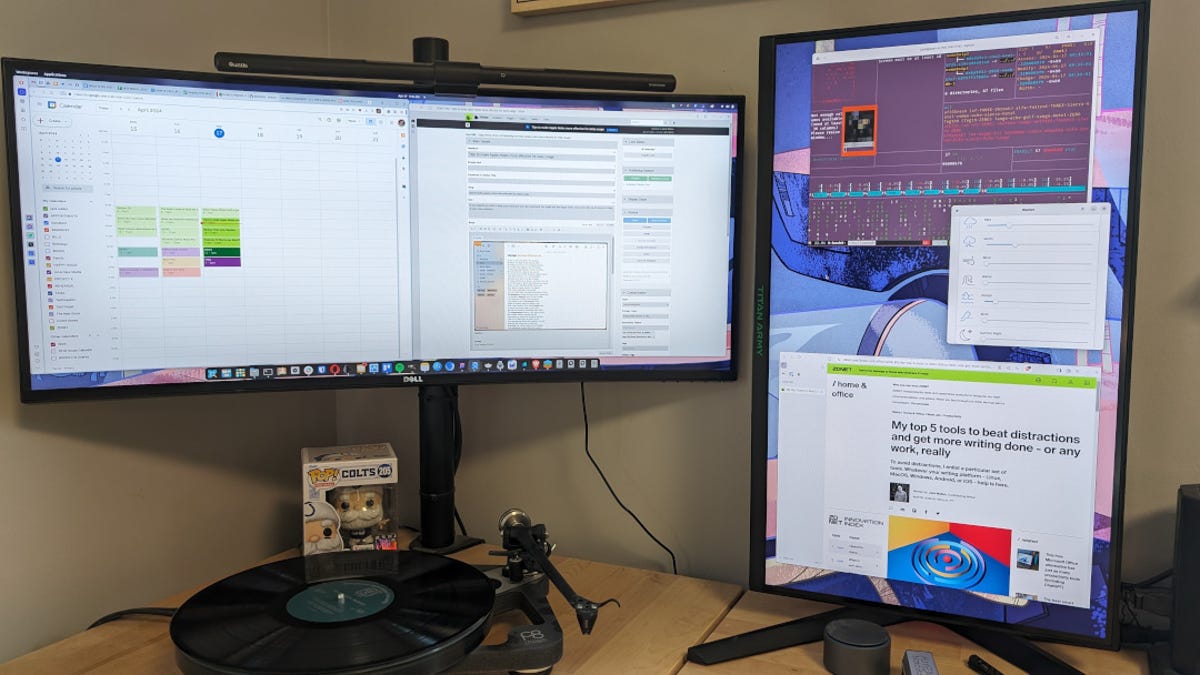

How I turned a cheap gaming monitor into the ultimate productivity tool

Jack Wallen/ZDNET ZDNET’s key takeaways The Titan Army 27″ gaming monitor is available on Amazon for $200. This monitor makes

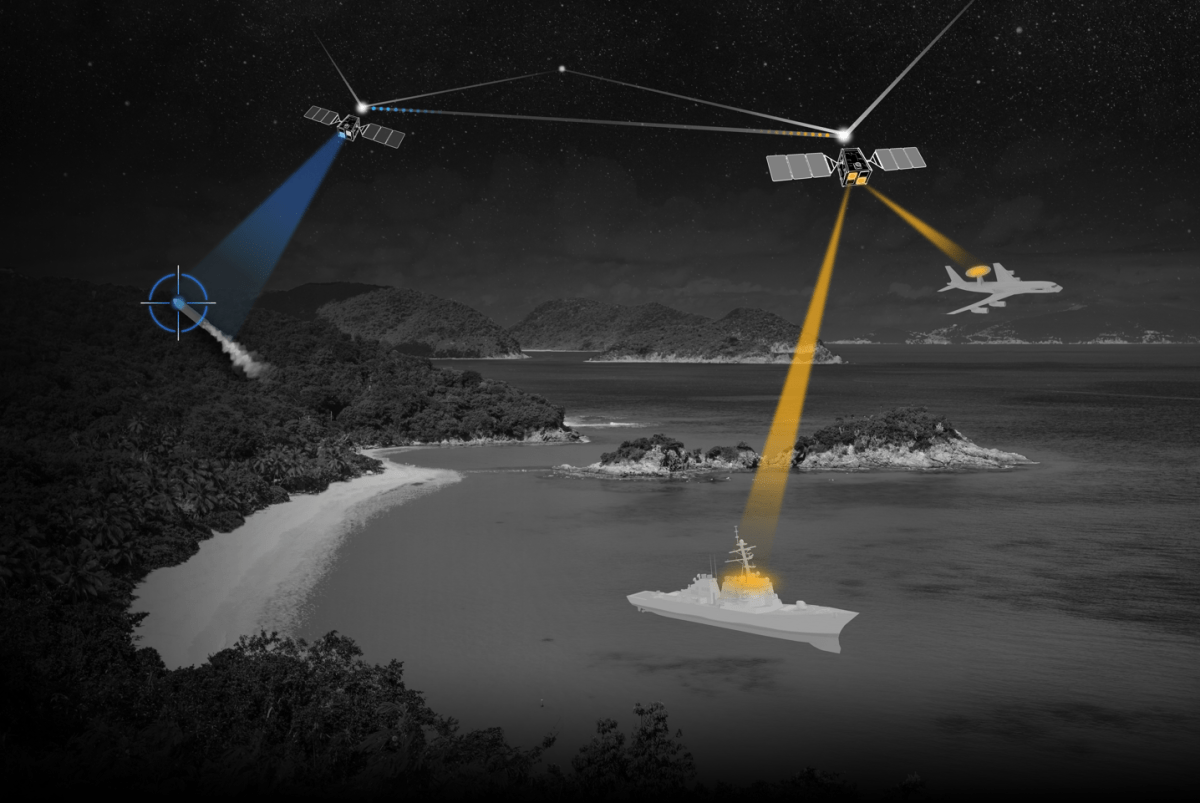

CesiumAstro claims former exec spilled trade secrets to upstart competitor AnySignal

CesiumAstro alleges in a newly filed lawsuit that a former executive disclosed trade secrets and confidential information about sensitive tech,

Your Android phone could have stalkerware — here’s how to remove it

Consumer-grade spyware apps that covertly and continually monitor your private messages, photos, phone calls and real-time location are a growing

World

Togo approves constitutional reform changing how president is elected | Elections News

Those opposed to the changes fear they could allow further extensions to President Faure Gnassingbe’s rule. Lawmakers in Togo have