Former England lock Geoff Parling has been named as Australia’s new lineout coach under Joe Schmidt, a little over a

TECHNOLOGY

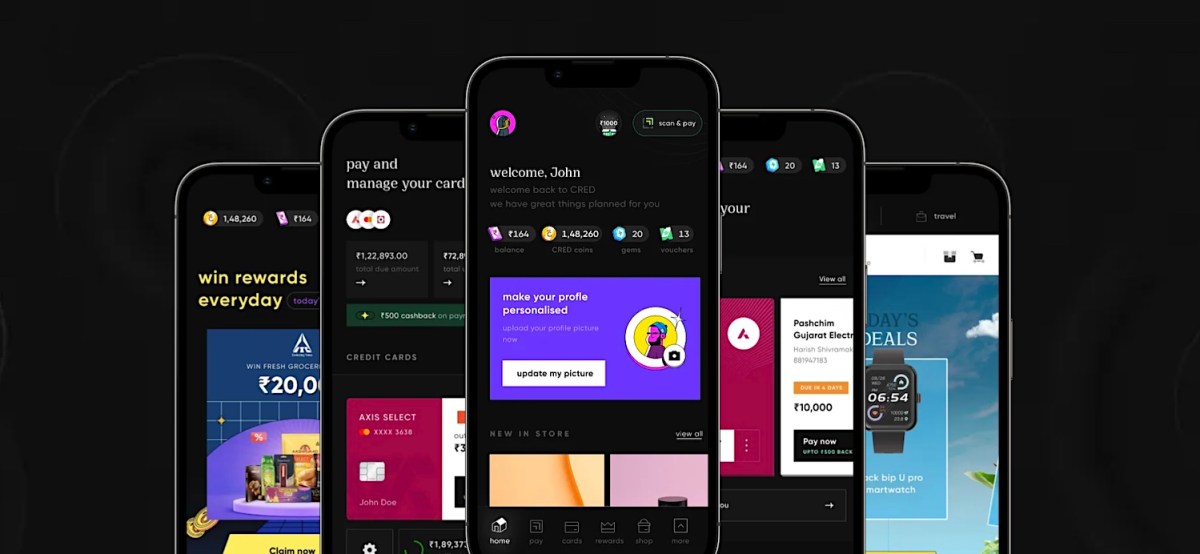

Fintech CRED secures in-principle approval for payment aggregator license

CRED has received the in-principle approval for payment aggregator license in a boost to the Indian fintech startup that could

Internet users are getting younger; now the UK is weighing up if AI can help protect them

Artificial intelligence has been in the crosshairs of governments concerned about how it might be misused for fraud, disinformation and

Hugging Face releases a benchmark for testing generative AI on health tasks

Generative AI models are increasingly being brought to healthcare settings — in some cases prematurely, perhaps. Early adopters believe that

I tested Samsung’s flagship laptop and it gave my MacBook Pro a run for its money

Samsung Galaxy Book 4 Ultra pros and cons Pros Large OLED touchscreen display High-performance laptop with discrete GPU Fantastic battery

Tesla still plans to build 1,800-mile charging corridor for semi trucks despite Biden funding snub

Tesla is pushing forward with a plan to build an electric big rig charging corridor stretching from Texas to California,

World

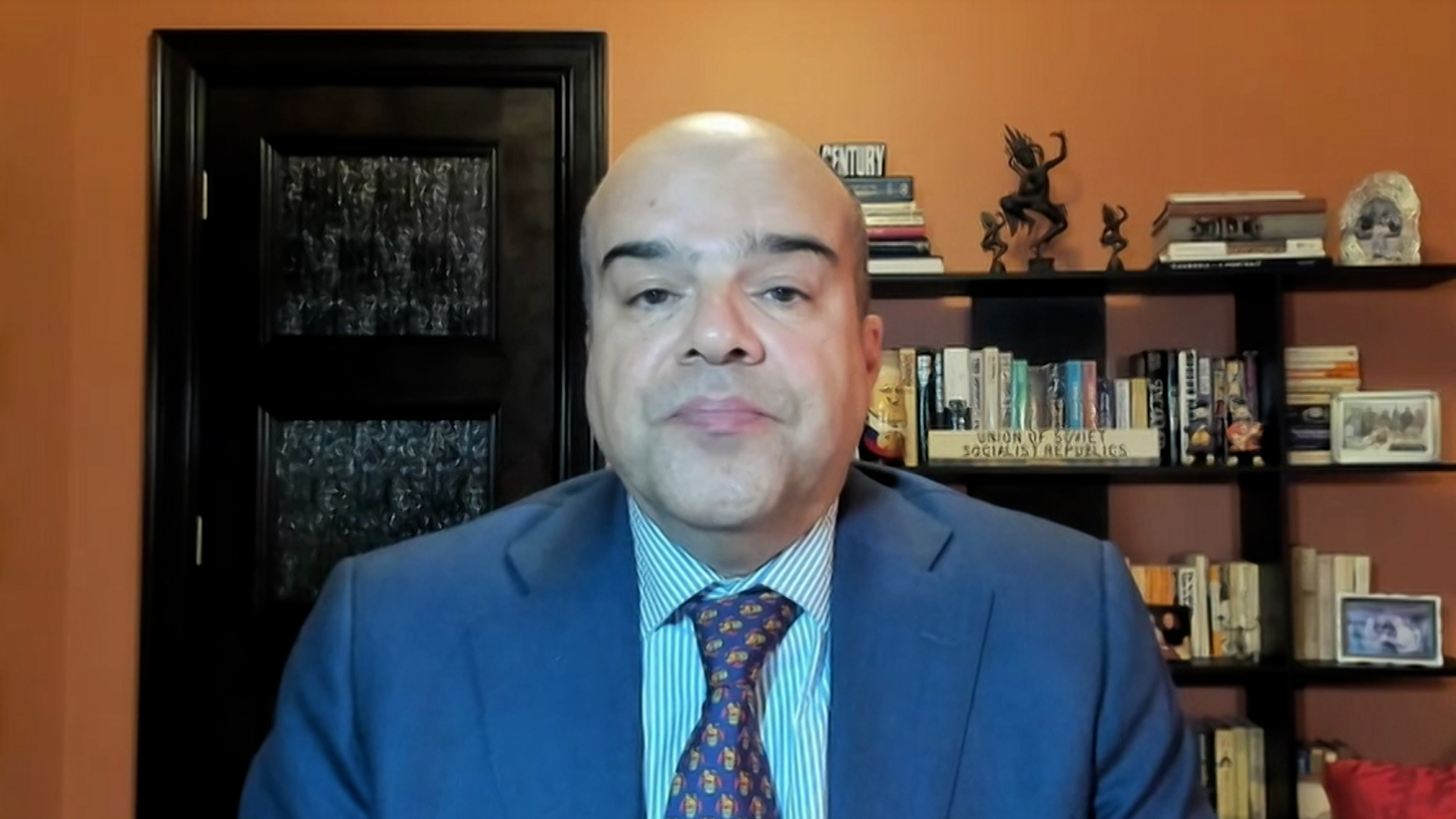

Israel ‘seems determined to drag the region into war’ says analyst | The World Wars

NewsFeed After the reported drone attack in Iran, Middle East analyst Mouin Rabbani says Israel appears intent on “dragging the