Sugnu, India – Ratan Kumar Singh, a 58-year-old high school teacher, never imagined he would be happy to see armed

LATEST NEWS

TECHNOLOGY

Big Tech’s ad transparency tools are still woeful, Mozilla research report finds

Efforts by tech giants to be more transparent about the ads they run are — at very best — still

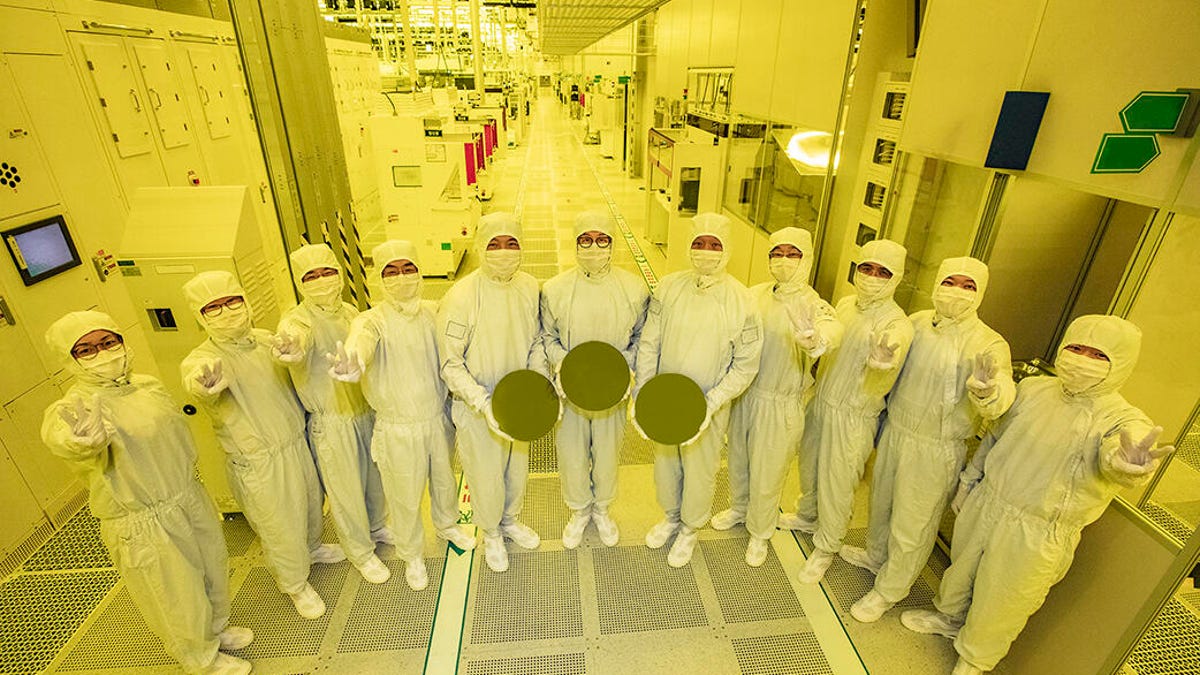

Samsung awarded $6.4 billion by U.S. under CHIPS Act to boost chip production

The U.S. government will give Samsung up to $6.4 billion in direct funding to boost its chip production in Texas,

Tesla layoffs hit high performers, some departments slashed, sources say

Tesla management told employees Monday that the recent layoffs — which gutted some departments by 20% and even hit high

Samsung retakes top phone sales spot from Apple as a third phone maker gains on them both

June Wan/ZDNET According to IDC, Samsung has overtaken Apple as the global leader in smartphone sales. (It was only three

Meta thinks it’s a good idea for students to wear Quest headsets in class

Meta continues to field criticism over how it handles younger consumers using its platforms, but the company is also planning

World

Behind India’s Manipur conflict: A tale of drugs, armed groups and politics | Business and Economy

Sugnu, India – Ratan Kumar Singh, a 58-year-old high school teacher, never imagined he would be happy to see armed