SOPA Images/Getty Images Although tech companies are racing to build bigger and better artificial intelligence models, there’s still significant value

TECHNOLOGY

Microsoft launches Phi-3 Mini, an AI model that is smaller but still rivals GPT-3.5

SOPA Images/Getty Images Although tech companies are racing to build bigger and better artificial intelligence models, there’s still significant value

Two widow founders launch DayNew, a social platform for people dealing with grief and trauma

After losing their husbands in devastating and unexpected ways, Karine Nissim and Eloise Bune D’Agostino discovered there were no suitable

My 9 must-have gadgets for creating quality YouTube videos

Want to learn how to create YouTube videos? You’ll need a few tools for stable shooting and high quality sound.

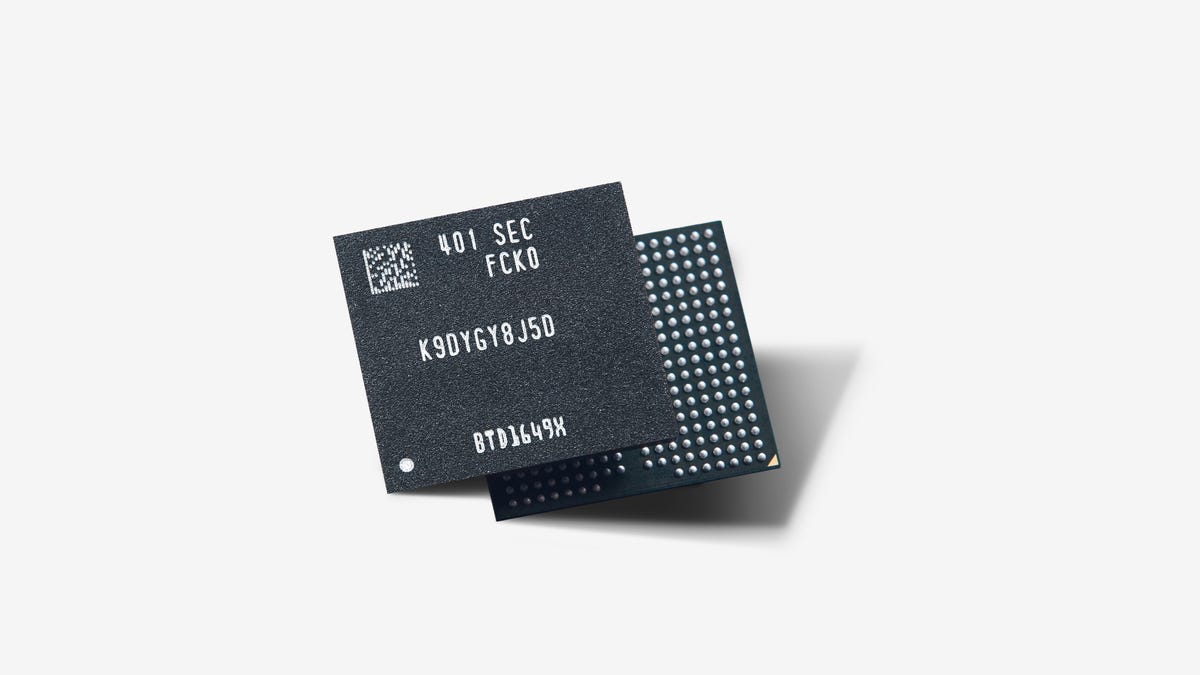

Samsung begins mass production of 9th-gen NAND with 50% upped bit density

Samsung has launched a new vertical NAND (V-NAND) with the highest bit density yet. The South Korean tech giant said

Rivian targets gas-powered Ford and Toyota trucks and SUVs with $5,000 ‘electric upgrade’ discount

Rivian is offering discounts up to $5,000 on its EVs — and a year of free charging — to customers

World

Modi accused of anti-Muslim hate speech | India Election 2024

NewsFeed India’s Prime Minister Narendra Modi has been accused of hate speech targeting Muslims after he referred to them as