Ukraine’s dwindling supply of air defence missiles enabled Russia to devastate its energy infrastructure with ever-increasing effectiveness during the past

TECHNOLOGY

Orbex’s new funding may accelerate its Prime microlauncher into orbit

UK-based small launch developer Orbex got another boost from Scotland’s national bank and other investors as it gears up for

India’s VerSe acquires Apple News+ rival Magzter

VerSe Innovation, the parent firm of Indian news aggregator app Dailyhunt, has acquired the popular digital newsstand platform Magzter, the

Consumer Financial Protection Bureau fines BloomTech for false claims

The U.S. Consumer Financial Protection Bureau (CFPB) said in an order on Tuesday that BloomTech, the for-profit coding bootcamp previously

Alphabet X’s Bellwether harnesses AI to help predict natural disasters

The world is on fire. Quite literally, much of the time quite literally. Predicting such disasters before they get out

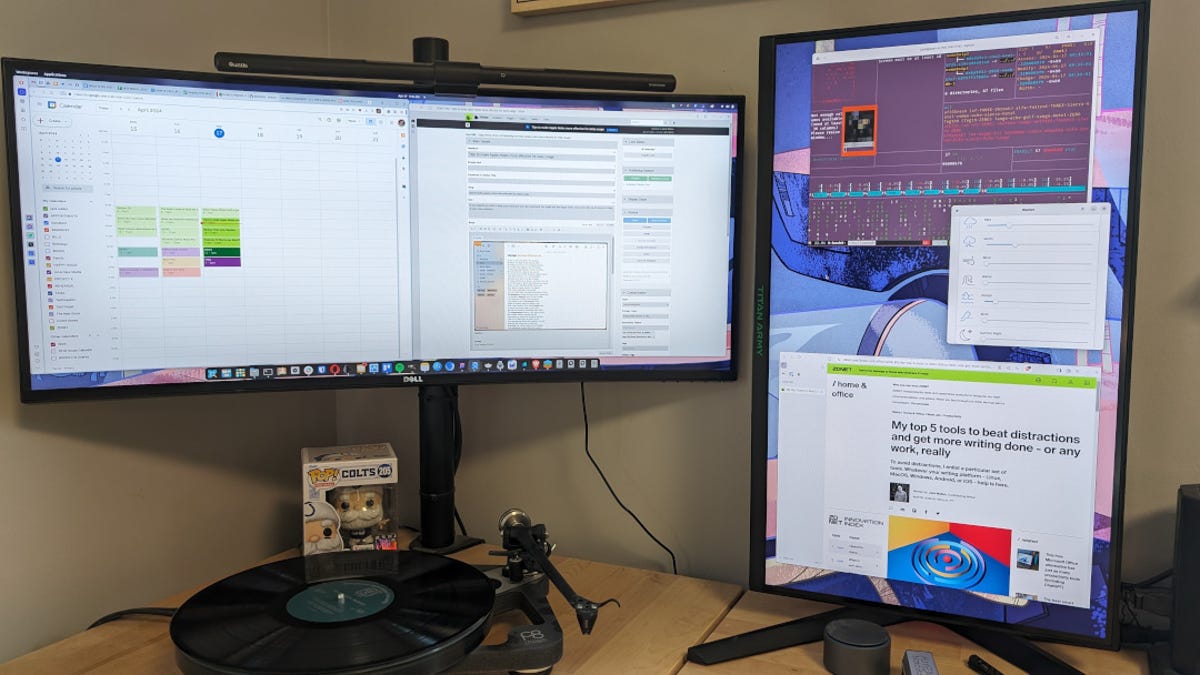

I’m not a gamer, but this gaming monitor sold me with a genius feature

Jack Wallen/ZDNET ZDNET’s key takeaways The Titan Army 27″ gaming monitor is available on Amazon for $200. This monitor makes

World

Russia pounds Ukraine’s cities and front lines as air defences dwindle | Russia-Ukraine war News

Ukraine’s dwindling supply of air defence missiles enabled Russia to devastate its energy infrastructure with ever-increasing effectiveness during the past