Thai police say the latest violence was triggered when Karen groups launched an attack against Myanmar troops. Fighting has broken

TECHNOLOGY

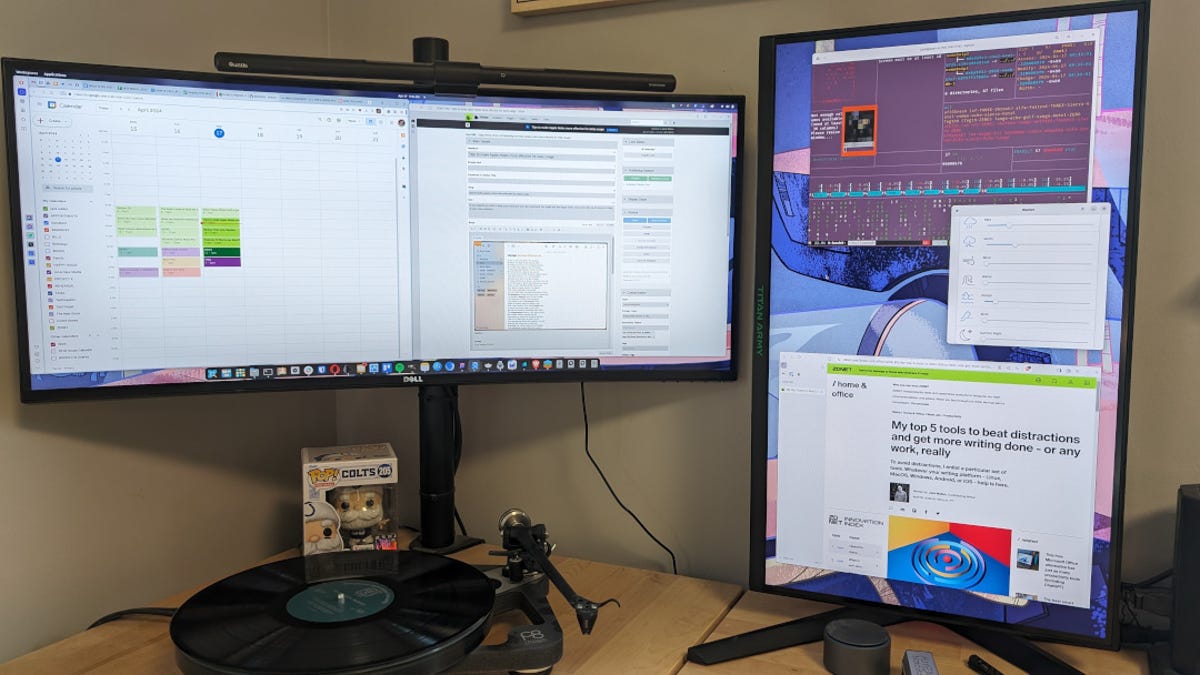

How I turned a cheap gaming monitor into the ultimate productivity tool

Jack Wallen/ZDNET ZDNET’s key takeaways The Titan Army 27″ gaming monitor is available on Amazon for $200. This monitor makes

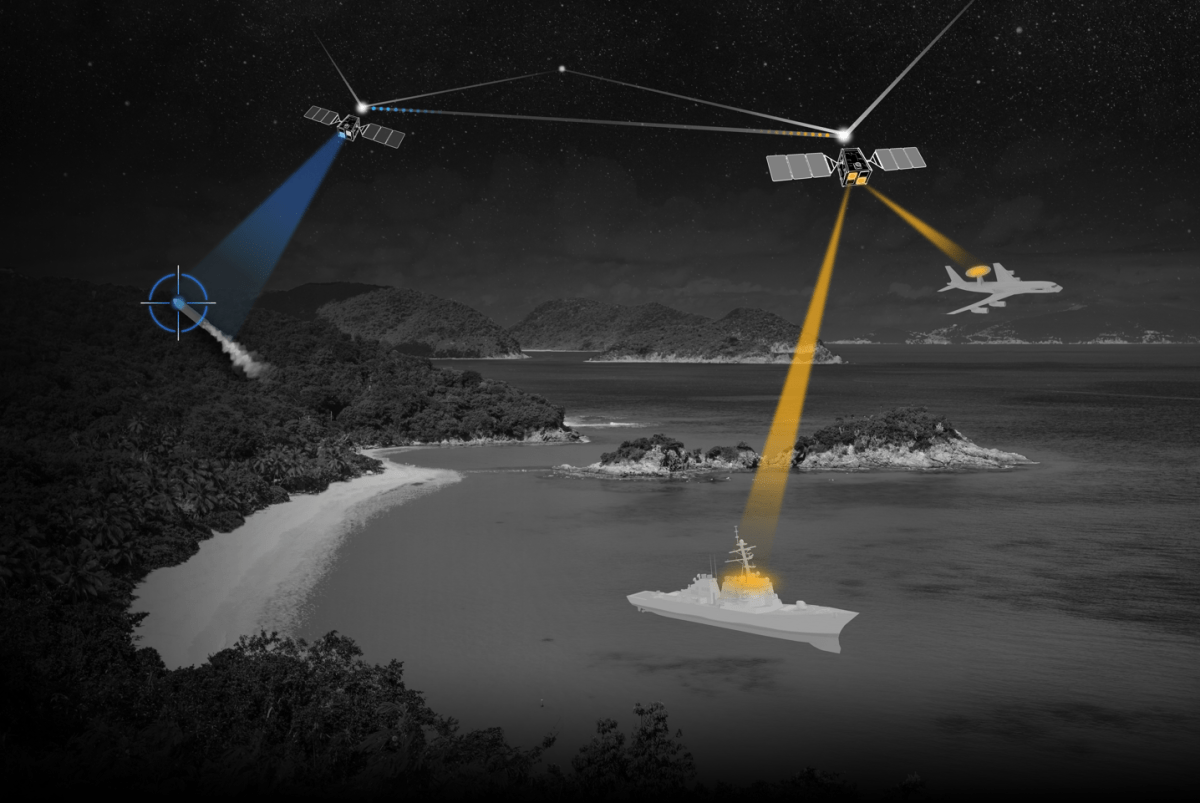

CesiumAstro claims former exec spilled trade secrets to upstart competitor AnySignal

CesiumAstro alleges in a newly filed lawsuit that a former executive disclosed trade secrets and confidential information about sensitive tech,

Your Android phone could have stalkerware — here’s how to remove it

Consumer-grade spyware apps that covertly and continually monitor your private messages, photos, phone calls and real-time location are a growing

Too many models | TechCrunch

How many AI models is too many? It depends on how you look at it, but 10 a week is

10 iPhone settings I changed to dramatically improve battery life

Max Buondonno/ZDNET No matter how much you use your iPhone, you’ve almost certainly thought about how to maximize its battery

World

Clashes break out at Thai-Myanmar border between soldiers, armed groups | Military News

Thai police say the latest violence was triggered when Karen groups launched an attack against Myanmar troops. Fighting has broken