NewsFeed The Ukrainian military says it shot down a Russian Tu-22M3 long-range bomber over Russian territory. Russia denies this, saying

TECHNOLOGY

Webflow acquires Intellimize to add AI-powered webpage personalization

Webflow, a web design and hosting platform that’s raised over $330 million at a $4 billion valuation, is expanding into

I can’t hike without these 5 tech gadgets

I’m a big fan of Shokz bone conduction headphones, and the OpenRun Pro are without a doubt my favorite version.

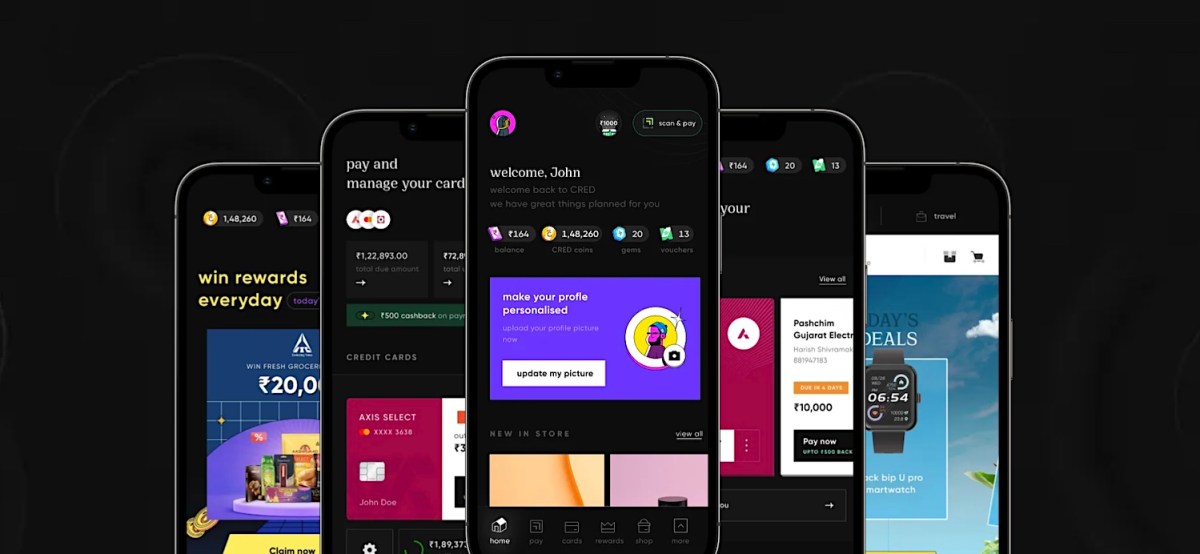

Fintech CRED secures in-principle approval for payment aggregator license

CRED has received the in-principle approval for payment aggregator license in a boost to the Indian fintech startup that could

Internet users are getting younger; now the UK is weighing up if AI can help protect them

Artificial intelligence has been in the crosshairs of governments concerned about how it might be misused for fraud, disinformation and

Hugging Face releases a benchmark for testing generative AI on health tasks

Generative AI models are increasingly being brought to healthcare settings — in some cases prematurely, perhaps. Early adopters believe that

World

Video captures alleged Ukrainian downing of Russian bomber in Russia | Newsfeed

NewsFeed The Ukrainian military says it shot down a Russian Tu-22M3 long-range bomber over Russian territory. Russia denies this, saying