NewsFeed A new mass grave has been discovered at al-Shifa Hospital where a two-week siege by the Israeli army has

TECHNOLOGY

Tesla layoffs hit high performers, some departments slashed, sources say

Tesla management told employees Monday that the recent layoffs — which gutted some departments by 20% and even hit high

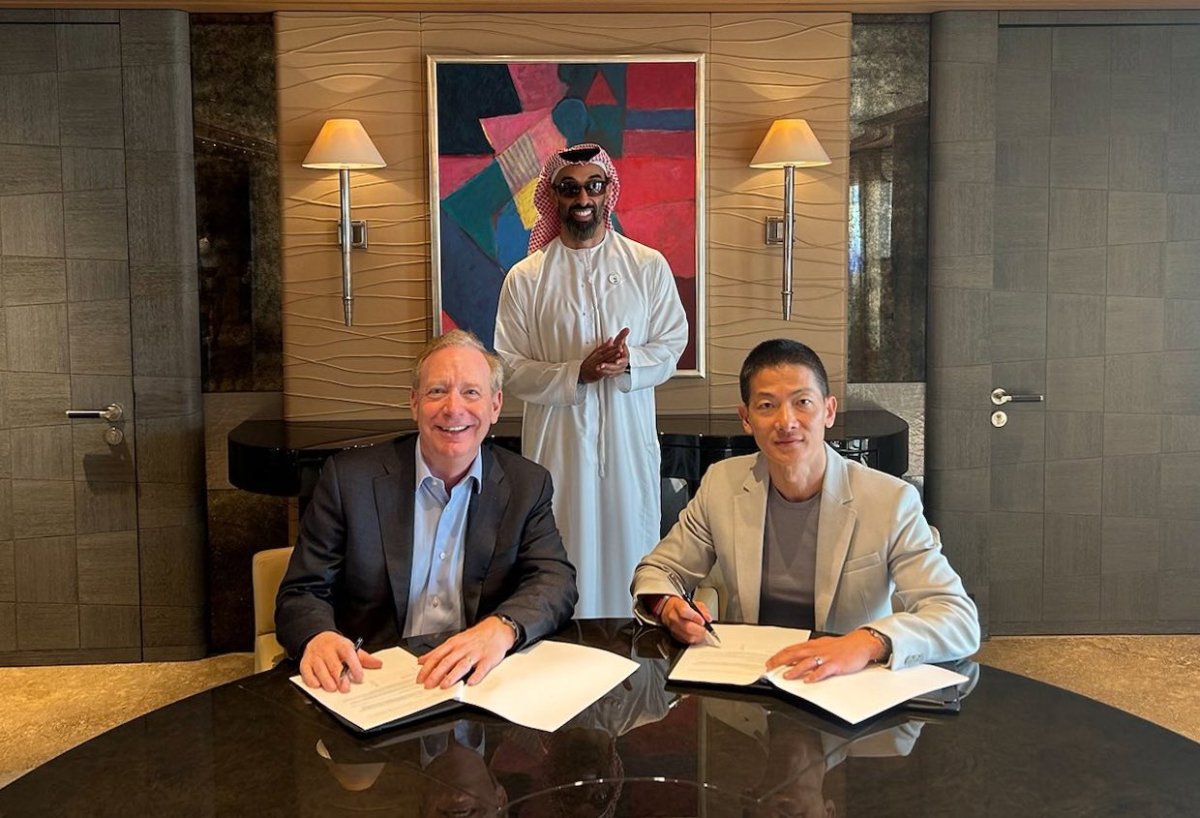

Microsoft’s $1.5B check for G42 shows growing US-China rift

As the Gulf region gains growing strategic importance for the tech war between the U.S. and China, Microsoft makes a

Big Tech’s ad transparency tools are still woeful, Mozilla research report finds

Efforts by tech giants to be more transparent about the ads they run are — at very best — still

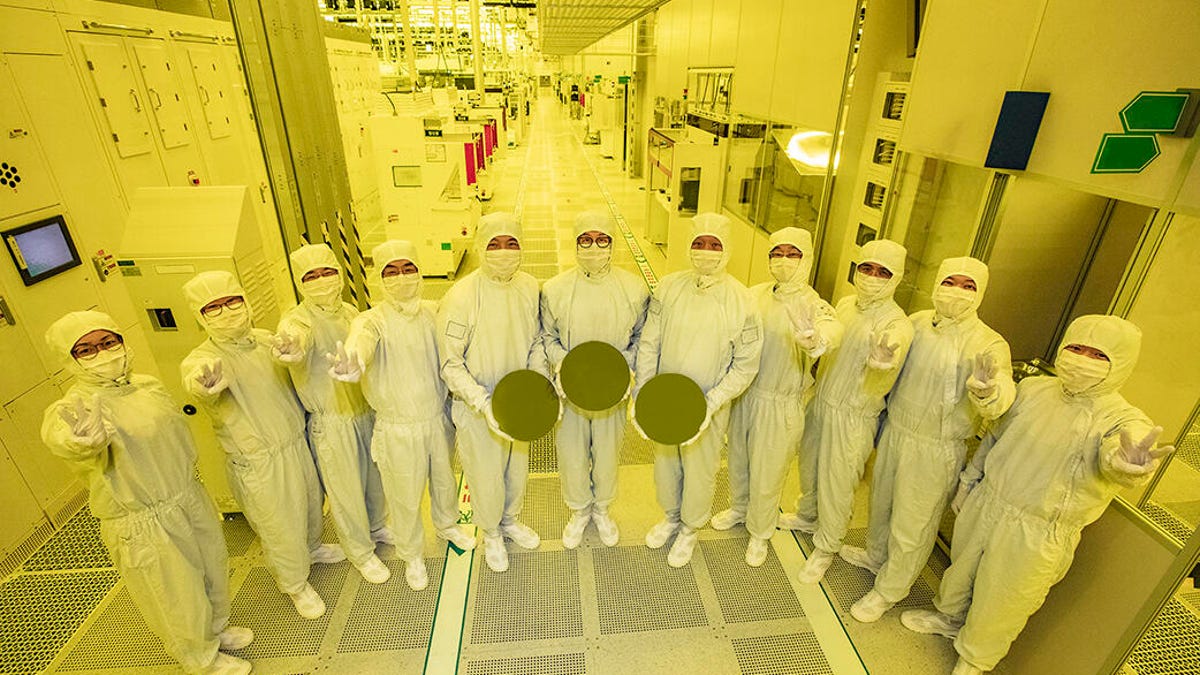

Samsung awarded $6.4 billion by U.S. under CHIPS Act to boost chip production

The U.S. government will give Samsung up to $6.4 billion in direct funding to boost its chip production in Texas,

Tesla layoffs hit high performers, some departments slashed, sources say

Tesla management told employees Monday that the recent layoffs — which gutted some departments by 20% and even hit high

World

Mass grave discovered at Gaza hospital occupied by Israeli forces | Gaza

NewsFeed A new mass grave has been discovered at al-Shifa Hospital where a two-week siege by the Israeli army has