Our Echo Pop, known as Ziggy, has become a staple in our home. Maria Diaz/ZDNET Amazon dropped its latest lineup

LATEST NEWS

TECHNOLOGY

Get an Echo Pop speaker for just $23 on Amazon

Our Echo Pop, known as Ziggy, has become a staple in our home. Maria Diaz/ZDNET Amazon dropped its latest lineup

Boston Dynamics’ Atlas humanoid robot goes electric

Atlas lies motionless in a prone position atop interlocking gym mats. The only soundtrack is the whirring of an electric

Getting a puppy? 4 things you absolutely need

My favorite pet tech simplifies my dog’s feeding schedule and keeps my home free of excessive pet fur. Source link

India scrambles to curb PhonePe and Google’s dominance in mobile payments

The National Payments Corporation of India (NPCI), the governing body overseeing the country’s widely used Unified Payments Interface (UPI) mobile

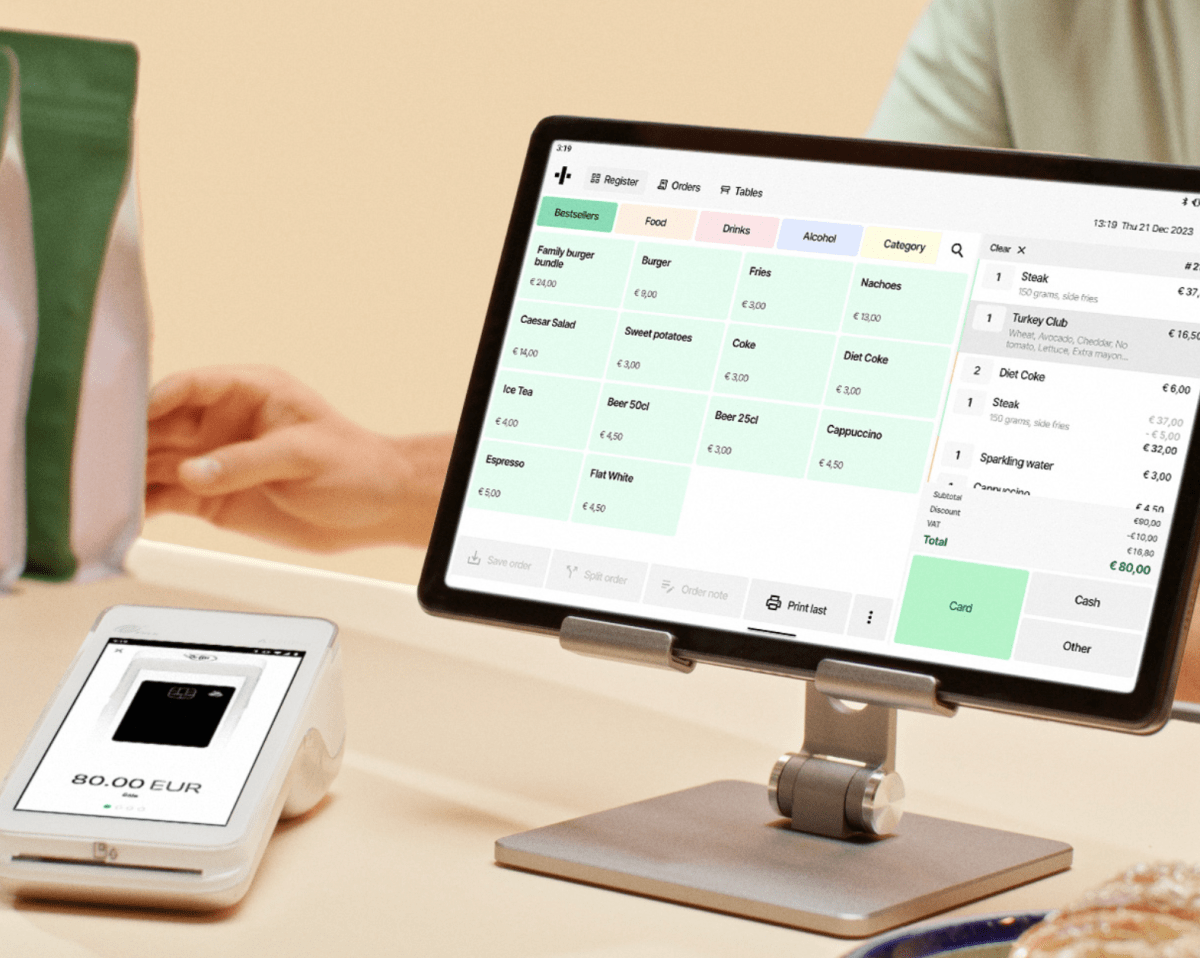

Flatpay rings up $47M to target smaller merchants with simple payment solutions

As the world waits for $65 billion payments tech giant Stripe to go public, a wave of smaller startups continues

World

Photos: Iran shows military might as tensions with Israel soar | Gallery News

As regional tensions run high, Iran has paraded drones, missiles and soldiers to show it is ready for a response