We independently selected these deals and products because we love them, and we think you might like them at these

TECHNOLOGY

Zomato’s quick commerce unit Blinkit eclipses core food business in value, says Goldman Sachs

Goldman Sachs said in a report late Thursday that Indian food delivery giant Zomato’s quick commerce arm Blinkit is now

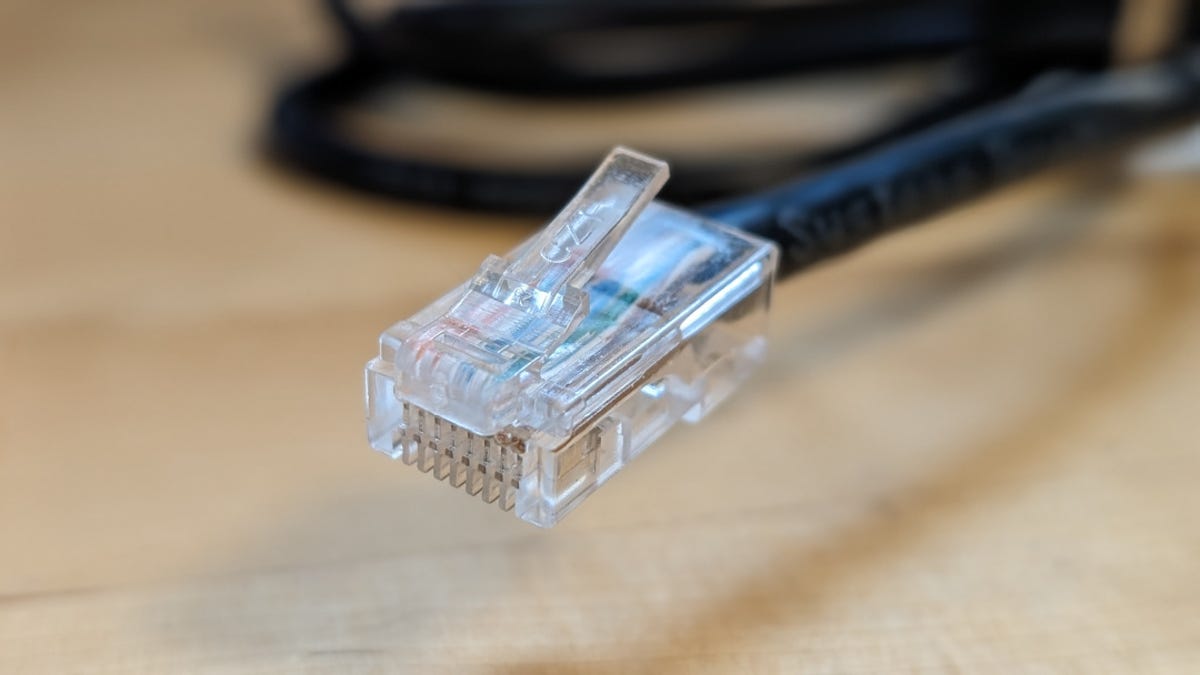

How to change your IP address, why you’d want to – and when you shouldn’t

Jack Wallen/ZDNET Security and privacy have been hot topics for a long time (and that’s not going to change any

Snap says total watch time on its TikTok competitor increased more than 125%

As part of its Q1 2024 earning release, Snap revealed that total watch time on its TikTok competitor, Spotlight, increased

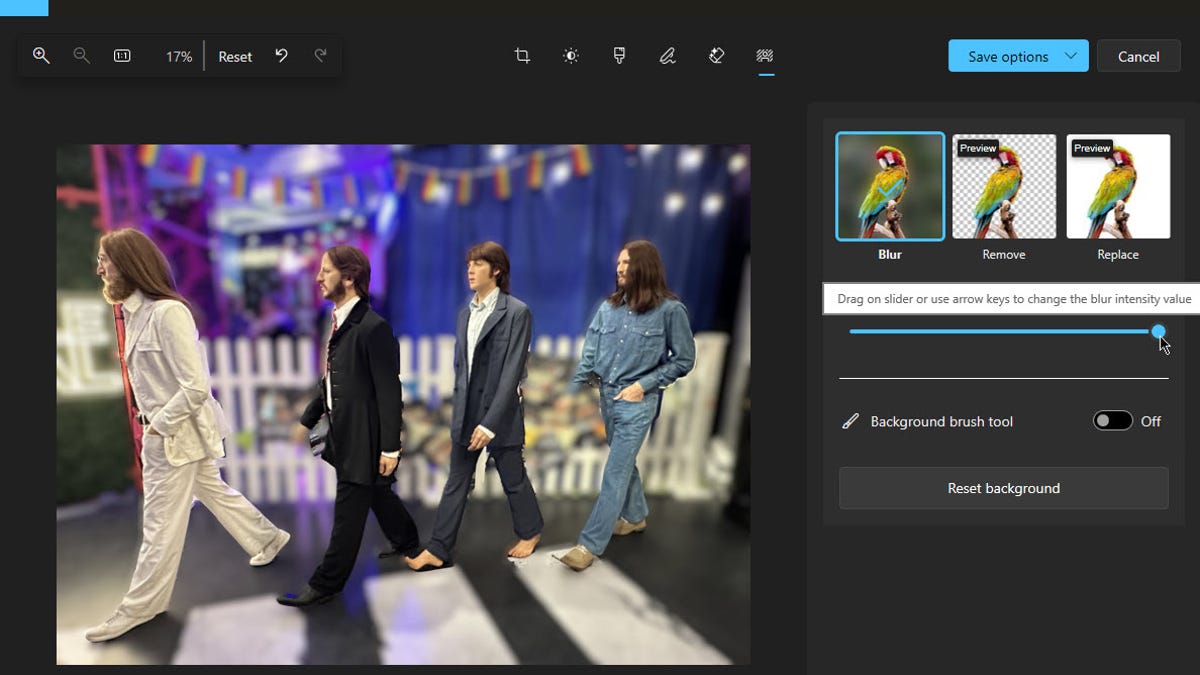

How to use AI in the Windows Photos app to change the background of an image

Screenshot by Lance Whitney/ZDNET You’ve snapped a memorable photo with your phone. There’s only one problem — you don’t like

Chilean instant payments API startup Fintoc raises $7 million to turn Mexico into its main market

Open banking may be a global trend, but implementation is fragmented. The fintech startups doing the legwork to make it

World

White nationalist rally ‘nothing’ compared with Gaza protests, Trump claims | Israel War on Gaza News

Former US president says Charlottesville rally was a ‘little peanut’ compared with pro-Palestinian student protests. Former United States President Donald