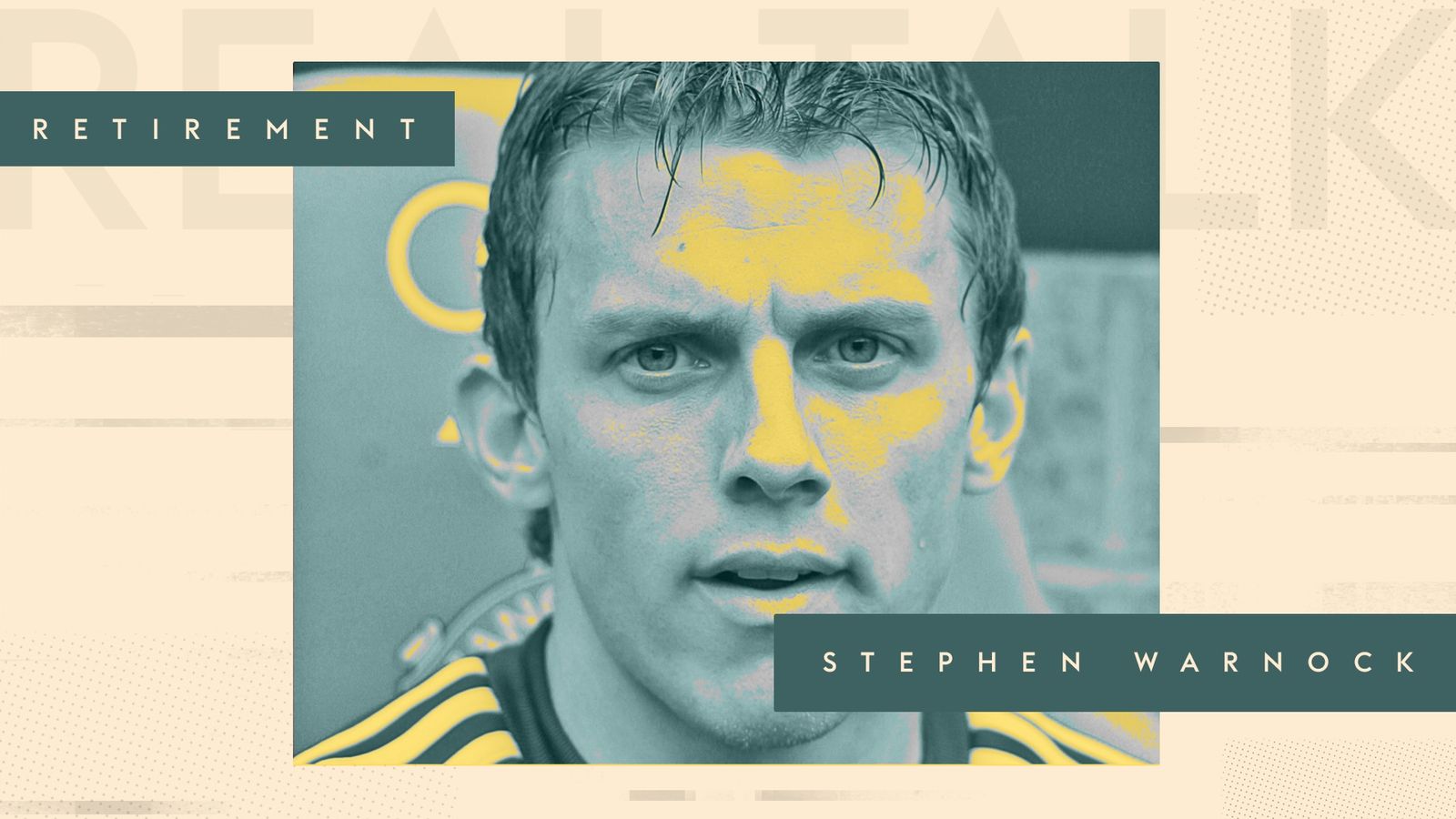

Screenshot by Lance Whitney/ZDNET You’ve snapped a memorable photo with your phone. There’s only one problem — you don’t like

TECHNOLOGY

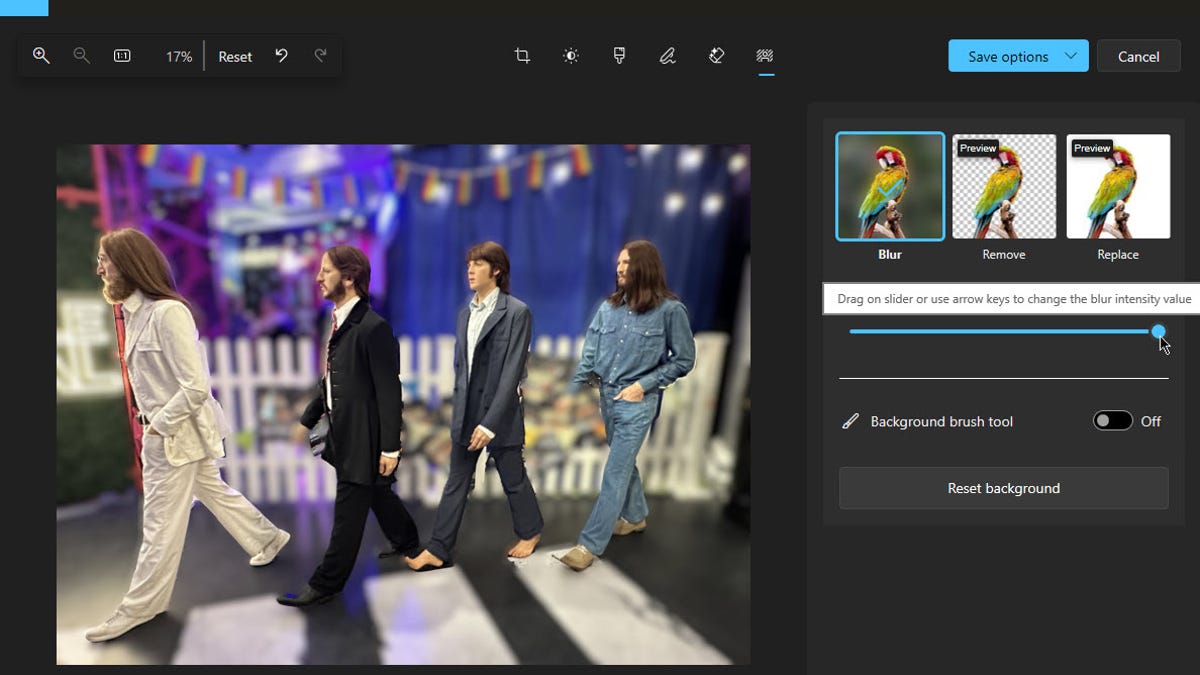

How to use AI in the Windows Photos app to change the background of an image

Screenshot by Lance Whitney/ZDNET You’ve snapped a memorable photo with your phone. There’s only one problem — you don’t like

Chilean instant payments API startup Fintoc raises $7 million to turn Mexico into its main market

Open banking may be a global trend, but implementation is fragmented. The fintech startups doing the legwork to make it

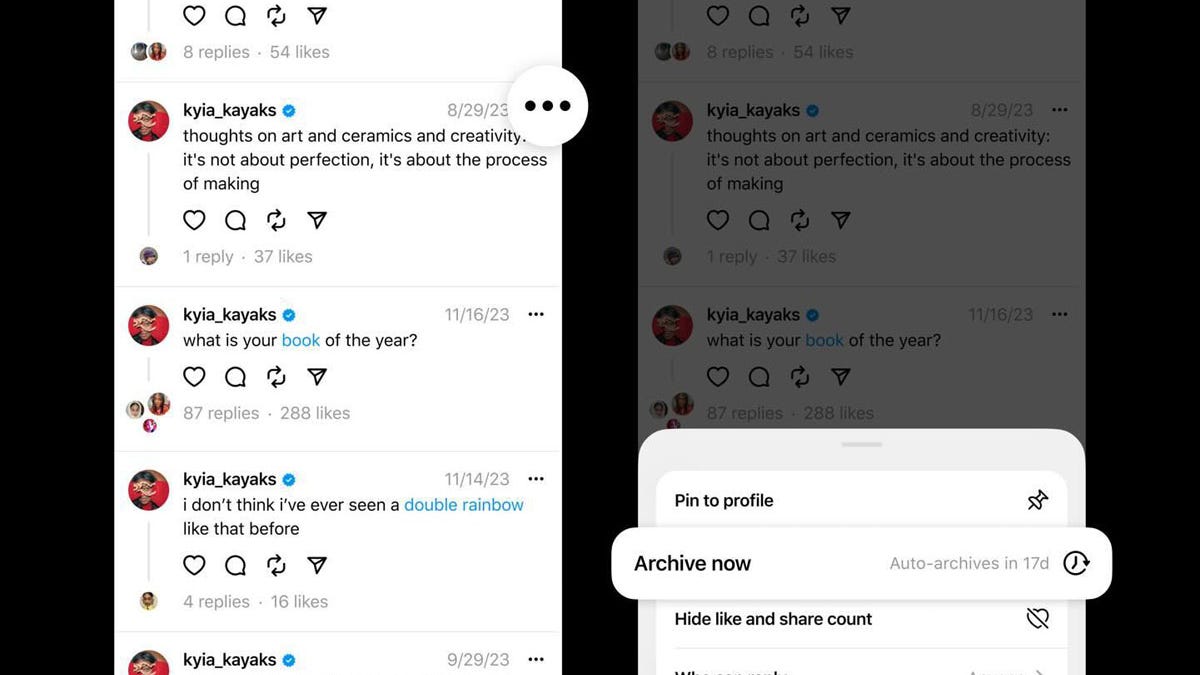

Threads tests letting you hide your public posts, as monthly users jump to over 150 million

Lance Whitney/ZDNET Meta is testing a new Threads feature that lets you archive your public posts, rendering them invisible to

Ex-NSA hacker and ex-Apple researcher launch startup to protect Apple devices

Two veteran security experts are launching a startup that aims to help other makers of cybersecurity products to up their

7 reasons I use Copilot instead of ChatGPT

Sabrina Ortiz/ZDNET The launch of OpenAI’s ChatGPT kicked off the generative AI craze and the tool has remained the most

World

‘Gaza Freedom Flotilla’ prepares to challenge Israeli blockade | Newsfeed

NewsFeed A ship with aid workers from 40 countries is hoping to leave a Turkish port on Friday and deliver