We independently selected these deals and products because we love them, and we think you might like them at these

TECHNOLOGY

Apple Vision Pro FAQ: Price, features, hands-on insights, and everything you need to know

Jason Hiner/ZDNET An Apple AR/VR headset — rumored for more than six years — finally became available this year. Eight

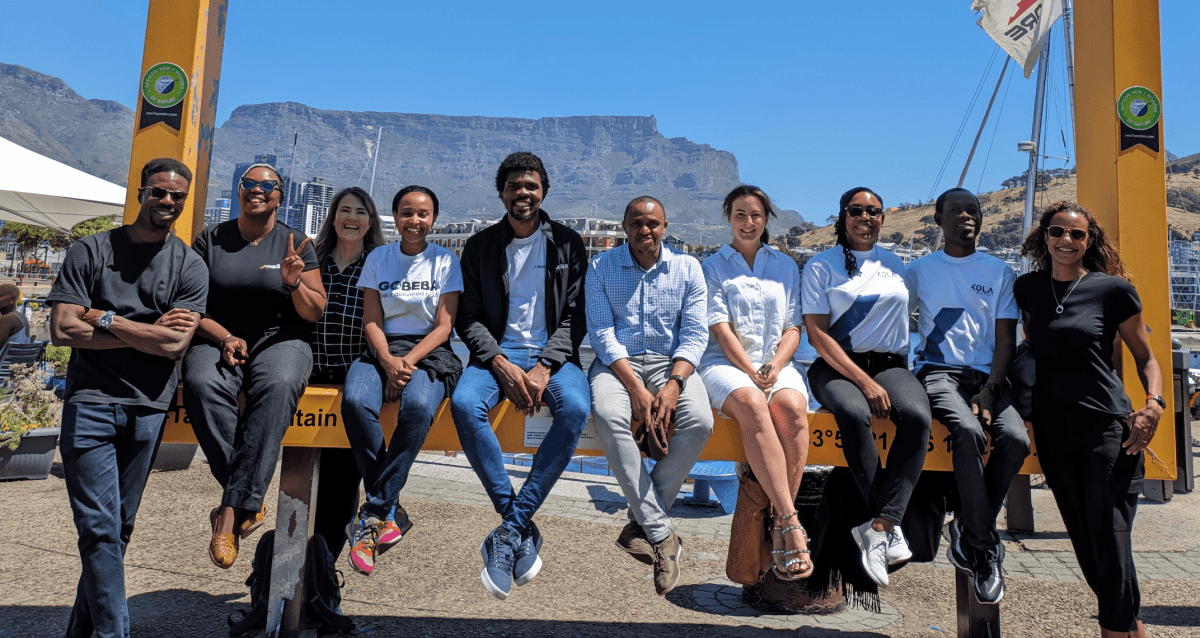

Madica, a program by Flourish Ventures, steps up pre-seed investing in Africa

Madica, an investment program launched by US-based investor Flourish Ventures to back pre-seed startups in Africa, plans to invest in

Google-backed Glance pilots Android lockscreen platform in US

Glance, which operates a lockscreen platform targetting Android smartphones, is setting its sights on the U.S. market. The Indian startup

Tesla’s new growth plan is centered around mysterious cheaper models

Tesla’s been undergoing some major changes, and now we have a sense of why: The company says it is upending

You can now buy an Oura Ring at Target – and get it sized right in the store

Target The Oura Ring has gotten so popular over the past few years that you now can buy the smart

World

Columbia pro-Palestine protesters face deadline to clear out: What’s next? | Israel War on Gaza News

Columbia University has told students protesting against Israel’s war on Gaza to clear their campus encampments by 8am (12:00 GMT)