After turning down the role of Hannah Montana to focus on her music career, the singer made her acting debut

TECHNOLOGY

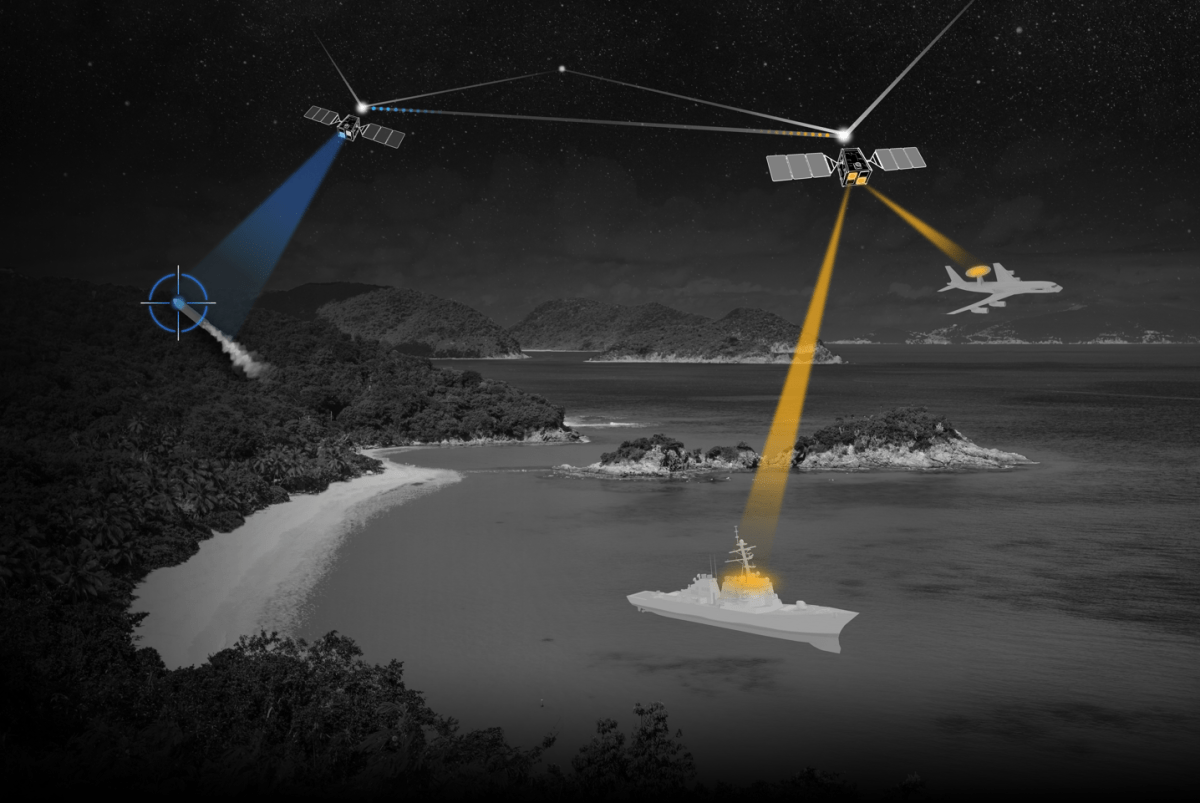

CesiumAstro claims former exec spilled trade secrets to upstart competitor AnySignal

CesiumAstro alleges in a newly filed lawsuit that a former executive disclosed trade secrets and confidential information about sensitive tech,

Your Android phone could have stalkerware — here’s how to remove it

Consumer-grade spyware apps that covertly and continually monitor your private messages, photos, phone calls and real-time location are a growing

Too many models | TechCrunch

How many AI models is too many? It depends on how you look at it, but 10 a week is

10 iPhone settings I changed to dramatically improve battery life

Max Buondonno/ZDNET No matter how much you use your iPhone, you’ve almost certainly thought about how to maximize its battery

The best wireless video doorbell for Ring fans is 20% off right now

Maria Diaz/ZDNET What’s the deal? The Ring Battery Doorbell Plus is discounted for $120 as part of a limited-time Amazon

World

Russia-Ukraine war: List of key events, day 786 | Russia-Ukraine war News

As the war enters its 786th day, these are the main developments. Here is the situation on Saturday, April 20,