After half a year of delays and debates, the US Congress has approved a $60.8bn military aid package for Ukraine,

LATEST NEWS

TECHNOLOGY

Microsoft is now showing ads in Windows 11’s Start menu. Here’s how to block them

NurPhoto/Getty Images Microsoft has rolled out a new way to further mismanage the Windows 11 Start menu: displaying ads in

UK probes Amazon and Microsoft over AI partnerships with Mistral, Anthropic, and Inflection

The U.K.’s Competition and Markets Authority (CMA) is launching preliminary enquiries into whether the close-knit tie-ups and hiring practices involving

Apple Vision Pro FAQ: Price, features, hands-on insights, and everything you need to know

Jason Hiner/ZDNET An Apple AR/VR headset — rumored for more than six years — finally became available this year. Eight

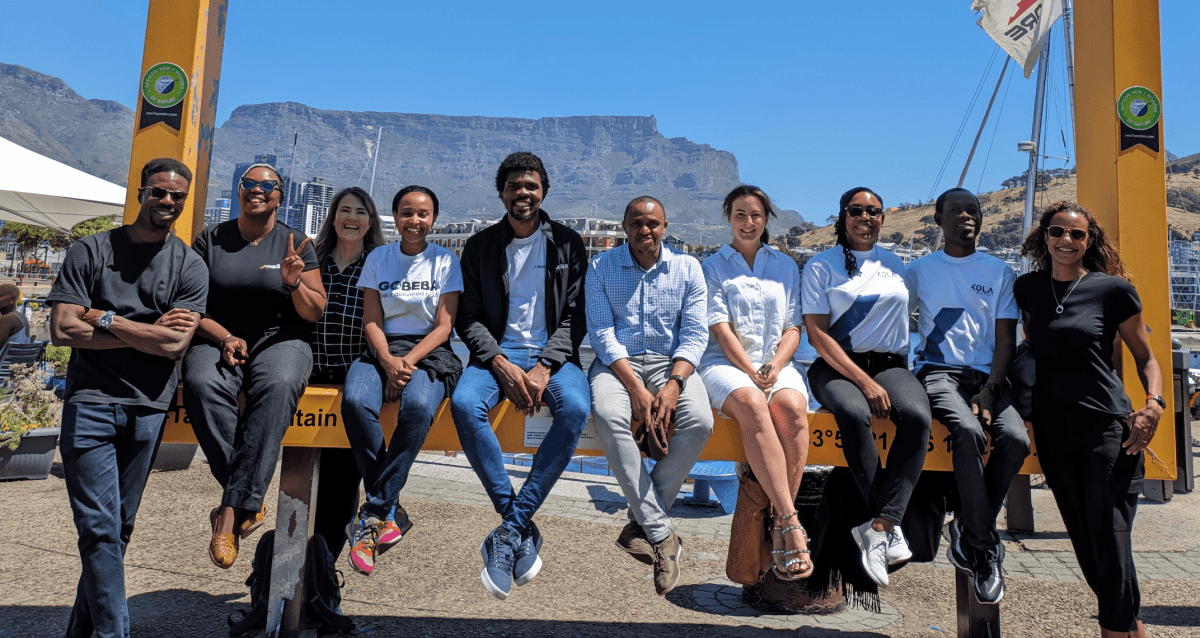

Madica, a program by Flourish Ventures, steps up pre-seed investing in Africa

Madica, an investment program launched by US-based investor Flourish Ventures to back pre-seed startups in Africa, plans to invest in

Google-backed Glance pilots Android lockscreen platform in US

Glance, which operates a lockscreen platform targetting Android smartphones, is setting its sights on the U.S. market. The Indian startup

World

Ukraine wins bipartisan US support, strikes Russia from afar | Russia-Ukraine war News

After half a year of delays and debates, the US Congress has approved a $60.8bn military aid package for Ukraine,